There is a surge in rental fraud today. In fact, Stake has measured certain properties where 48% of leases signed end up with a resident who doesn’t move-in. This extends days on market and causes losses and budget misses for marketing and leasing teams.

Unfortunately, few properties and CRM tools measure Lease-to-Close. This is the measurement of the number accepted leases that result in a move-in. Yet, it costs $1,300 on average per lost lease. That means $300,000 in lost revenue a year in a 200 unit property with a average rent of $1,500 a month per unit. Until now.

Introducing Stake’s latest Loyalty Cloud feature: Lease-to-Close.

Lease-to-Close — included free in Stake’s Loyalty Cloud where you can see The Data for free — is the only revenue management and CRM tool to not only track how many leases actually close but how much more properties outperform Lease-to-Close with incentives.

This means Stake’s Lease-to-Close is not just a tool to measure, but a tool to solve.

Lease-to-Close is one more example of empowering properties with The Data: Know it. Act on it. Optimize it.

Specifically, Lease-to-Close empowers properties to:

✅ Benchmark how many leases “close” (end in successful move-ins) by property

✅ Track Lease-to-Close by unit type

✅ Track and compare Lease-to-Close rates across different promotions, incentives, and rewards

Lease-to-Close is available for free in Loyalty Cloud for properties in the Stake Network. It's incredibly fast and easy to use, and empowers on-site, revenue, and asset management teams to better target their incentives and outperform the market.

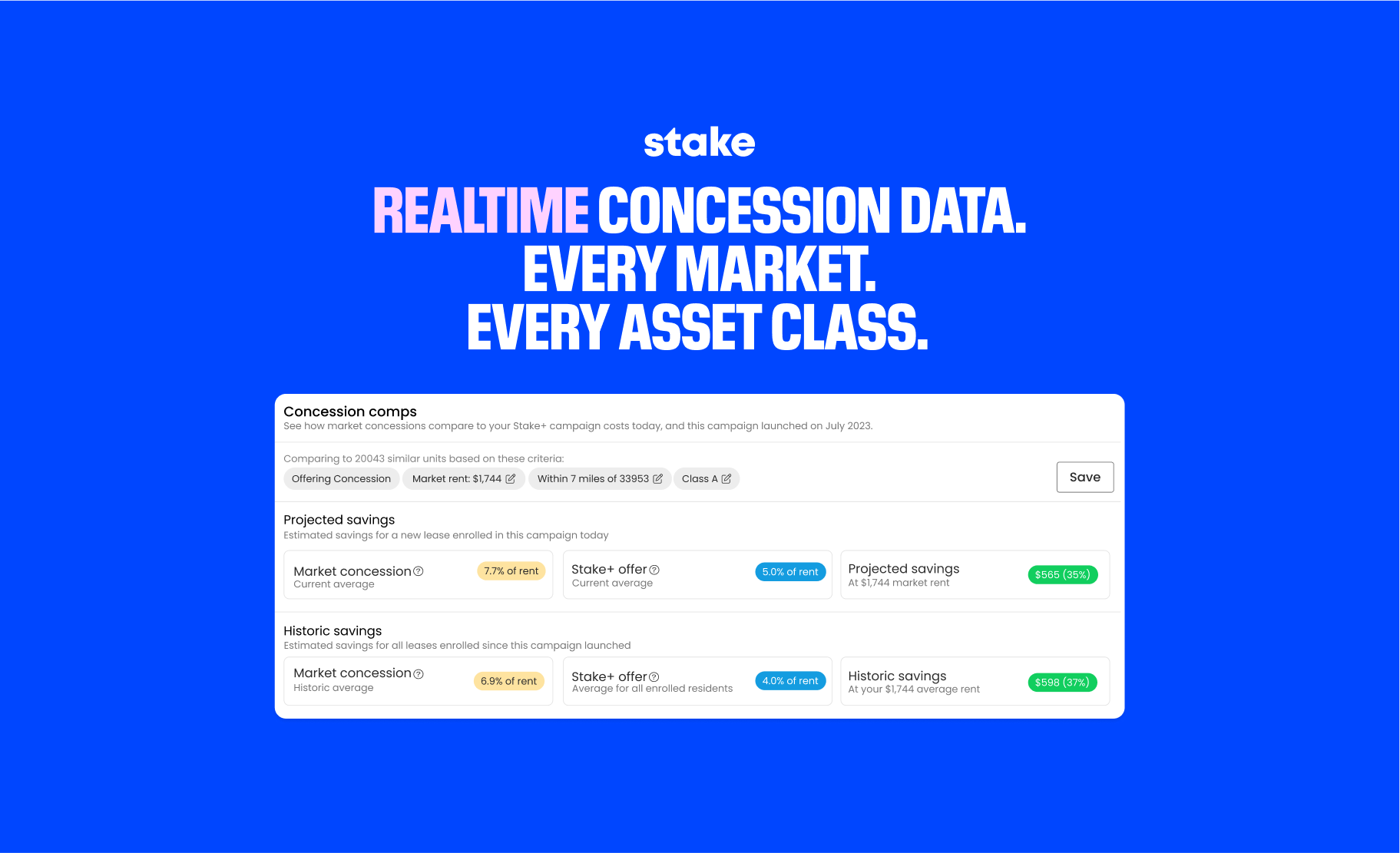

Lease-to-Close is the latest addition to Loyalty Cloud, including the recently released Concession Comps and Ai Comp: Days on Market tools. Loyalty Cloud's existing suite of tools empowers 70,000+ units across the United States with over $1.5 billion in annual leases to:

✅ Understand and improve payment behavior to reduce delinquency

✅ Track and lower days on market with Ai Comp: Days on Market

✅ Track net effective rent with Concession Comps

✅ Manage incentive campaigns: offers, lease-terms, seasonality, property and unit type.

✅ Set incentive actions: lease signing, lease renewals, and rent payments

✅ Track resident sentiment with StakeSay

✅ Improve resident data integrity by increasing accuracy of contact info

✅ Gain insights into anonymized and aggregated resident spending behavior

What is Lease-to-Close?

When renters sign a lease, the deal is still not sealed. The lease must be accepted by the property, and the renter still needs to move in. Some renters are denied after signing the lease, and many renters sign a lease, then cancel. A cancellation means they never move in, onsite team hours are wasted, and revenue is not created. This leaky bucket results in lost revenue.

How much is lost when leases do not close? What can a property save?

Let’s look at a cost of a lease signing:

- Marketing

- Days on Market

- On-site team costs

On average, these costs total $1,300 per unit.

With an average non-close rate of 50%, this means per 100 doors properties are losing $137,000 on failed lease-to-close.

Stake Network properties improve Lease-to-Close rate by over 20% saving over $165,000 per property. Why? Because adding a Cash Back reward attracts a Staker with a high propensity to move-in, stay, and want to redeem the reward.

Why compare Lease-to-Close to incentive offers?

It isn’t enough just to know lease-to-close is a problem, properties need the tools to change it. Incentives — such as Stake’s Cash Back — can positively change lease-to-close. But it must be tracked.

With the right data, attribution, and large enough data sets on comparable incentives, Stake’s Lease-to-Close features tracks Cash back offers to see how well the offer is helping properties reduce Lease-to-Close and therefore return more money to the property.

One more way Stake’s Loyalty Cloud helps properties outperform.

Why is Stake’s Lease-to-Close free? And what else is free with Stake?

Stake only makes money when properties successfully offer Cash Back to residents. It is in Stake’s interest to offer as many tools as possible to help properties better price concessions, attract residents, and reduce economic vacancy. In fact, Stake's customers only pay for success.

But Stake doesn’t just offer all the tools in Loyalty Cloud for free, Stake offers free financial amenities to all residents in the Stake Network as well. It's simple to start, see the impact Stake can bring, and be prepared for the uncertain concessions market ahead.

How to start with Lease-to-Close

Stake isn’t just a DIY solution, Stake provides a complete “do it for me” service. That’s AI plus our hands-on Property Performance team.

Sign up for free, see the insights, and spend only once you are comfortable with the recommendations. Even then - test, optimize, and rely on Loyalty Cloud or our Property Performance team to do the work for you. No extra time for teams, just smarter, better ways to tackle the big issues and drive revenue up.

Contact below to get started with Lease-to-Close, free financial amenities and rewards, or just to ask Stake’s team to pull some comps data for you.

.jpeg)